Investment Strategies: Effective Approaches for a Diversified Portfolio

As a business journalist, I have been following the recent market trends and analyzing the performance of various companies. In this article, we will discuss effective investment approaches, risk management techniques, and portfolio diversification strategies to help you make informed investment decisions.

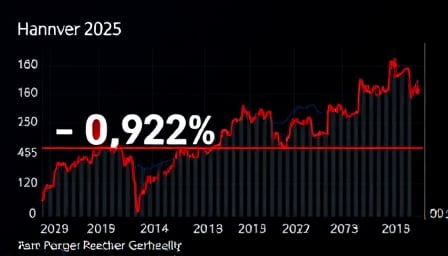

Market Update: Recent Performance of DAX-30 Companies

The DAX-30 index has been experiencing fluctuations in recent days. Let’s take a closer look at the performance of some of the prominent companies in the index.

- Hannover Rueck (HNR1.DE): The company’s stock price has decreased by 0.42% in the last 24 hours, trading at around €257.94. The current market capitalization stands at €31.2 billion.

- Henkel & (HEN.DE): The company’s stock price has increased by 1.55%, trading at around €84.86. The current market capitalization stands at €31.5 billion.

- Rheinmetall (RHM.DE): The company’s stock price has increased by 0.62%, trading at around €754.84. The current market capitalization stands at €32.7 billion.

- Deutsche Bank (DBK.DE): The company’s stock price has decreased by 3.22%, trading at around €19.01. The current market capitalization stands at €36.4 billion.

- Daimler Truck (DTG.DE): The company’s stock price has increased by 1.42%, trading at around €42.36. The current market capitalization stands at €33.2 billion.

- Biontech (22UA.DE): The company’s stock price has decreased by 0.42%, trading at around €117.7. The current market capitalization stands at €28.4 billion.

Risk Management Techniques

Investing in the stock market involves inherent risks. To mitigate these risks, it is essential to employ effective risk management techniques.

- Diversification: Spread your investments across various asset classes, sectors, and geographies to minimize risk.

- Dollar-cost averaging: Invest a fixed amount of money at regular intervals, regardless of the market conditions, to reduce the impact of market volatility.

- Stop-loss orders: Set a stop-loss order to limit your potential losses in case the stock price falls below a certain level.

- Hedging: Use derivatives or other financial instruments to hedge against potential losses.

Portfolio Diversification Strategies

A well-diversified portfolio can help you achieve your investment goals while minimizing risk.

- Asset allocation: Allocate your investments across various asset classes, such as stocks, bonds, and commodities, to balance risk and potential returns.

- Sector rotation: Invest in sectors that are expected to perform well in the future, while reducing exposure to sectors that are experiencing difficulties.

- International diversification: Invest in international markets to benefit from global economic growth and diversify your portfolio.

Conclusion

Investing in the stock market requires a well-thought-out strategy and a deep understanding of the market trends. By employing effective risk management techniques and diversifying your portfolio, you can minimize risk and achieve your investment goals. Remember to stay informed about market developments and adjust your investment strategy accordingly.

About Hannover Rueck

Hannover Rueck SE is a financial services company based in Hannover, Germany. The company offers various types of reinsurance services, including life, health, accident, property, and high-risk special insurance.