Investment Strategies: Effective Approaches for Mitigating Risk and Maximizing Returns

As a seasoned financial expert, I will outline effective investment approaches, risk management techniques, and portfolio diversification strategies to help you navigate the complexities of the stock market.

Investment Strategies

1. Diversification

Diversification is a fundamental principle of investing. By spreading your investments across various asset classes, sectors, and geographies, you can minimize risk and maximize returns. Consider allocating your portfolio to a mix of:

- Stocks: Equities offer potential for long-term growth, but come with higher volatility.

- Bonds: Fixed-income securities provide regular income and lower risk.

- Real Estate: Invest in property or real estate investment trusts (REITs) for steady returns.

- Commodities: Diversify with gold, oil, or other commodities to hedge against inflation.

2. Risk Management

Risk management is crucial to protecting your investments. Consider the following strategies:

- Dollar-cost averaging: Invest a fixed amount of money at regular intervals, regardless of market conditions.

- Stop-loss orders: Set a price level at which to sell a security to limit potential losses.

- Hedging: Use derivatives or other instruments to mitigate potential losses.

3. Active vs. Passive Investing

Active investing involves trying to beat the market through stock selection and timing. Passive investing, on the other hand, involves investing in index funds or ETFs that track a specific market index.

- Active investing: Suitable for experienced investors with a solid understanding of the market and a well-researched investment strategy.

- Passive investing: A more straightforward approach that eliminates the need for constant monitoring and trading.

4. Long-Term Investing

Long-term investing involves holding onto your investments for an extended period, typically five years or more. This approach allows you to ride out market fluctuations and benefit from compound interest.

- Compound interest: The interest earned on both the principal amount and any accrued interest.

- Time horizon: The length of time you can afford to keep your money invested.

5. Tax-Efficient Investing

Tax-efficient investing involves minimizing tax liabilities by optimizing your investment portfolio.

- Tax-loss harvesting: Selling securities that have declined in value to realize losses and offset gains.

- Tax-deferred accounts: Utilize tax-deferred accounts, such as 401(k) or IRA, to delay tax payments.

Case Study: Vonovia SE

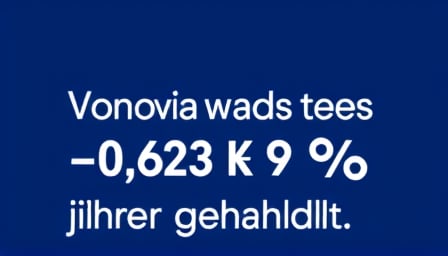

Vonovia SE, a leading German real estate company, has experienced significant growth over the past decade. However, the company faces challenges, including a court ruling against it in a dispute over additional costs for tenants. This ruling could set a precedent for other tenants and potentially impact the company’s future profitability.

Related Stocks

- Uniper (UN0.DE): A German energy company facing uncertainty due to rumors of a potential partial sale of the government’s majority stake.

- Talanx (TLX.DE): A German insurance company with a high price-to-earnings ratio, indicating potential for growth.

- Dr. Ing. h.c. F. Porsche (P911.DE): A German luxury car manufacturer with a high price-to-earnings ratio, indicating potential for growth.

- MTU Aero Engines (MTX.DE): A German aerospace company with a high price-to-earnings ratio, indicating potential for growth.

- Bayer (BAYN.DE): A German pharmaceutical and life science company with a stable stock price and potential for growth in the biotechnology sector.

Conclusion

Investing in the stock market requires a well-thought-out strategy, risk management techniques, and a diversified portfolio. By understanding the principles outlined above, you can make informed investment decisions and navigate the complexities of the stock market.